Filing for bankruptcy might be the only option you have to possibly save your home. There are auto financing options for individuals that have to file or have filed for bankruptcy. You should understand the 2 types of bankruptcies you can file and which fits you better. Bankruptcy financing and understanding how to navigate through it is critical.

Chapter 7 vs Chapter 13 – This article in a nutshell explains the difference between the two. I have observed over two decades in the auto industry that a lot of consumers make, what is in my opinion, the wrong bankruptcy filing choice.

Thinking about filing for bankruptcy:

- own property and want to keep it but are experiencing financial difficulty usually Chapter 13

- want to eliminate all of your debt and start all over from scratch can file a Chapter 7 bankruptcy.

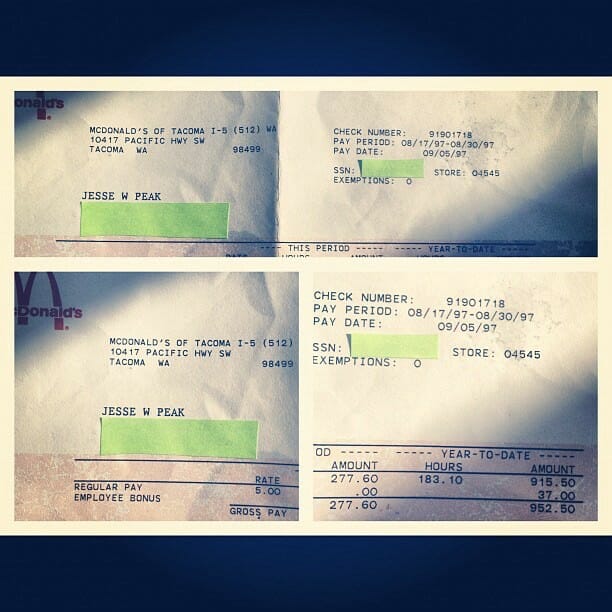

When the loan is submitted for a client with a bankruptcy on his/her credit a call to the lender is made. Lenders list item by item what has been included in the bankruptcy. When a consumer files a 13 and there is no real estate included, this question is always asked… Why did this person file for Chapter 13?

I am not a Bankruptcy attorney not giving advice but if you are thinking about filing for bankruptcy, please do your research and understand the difference between the two. Yes there are a few great lenders that will finance a car while you are in the middle of your bankruptcy. Apply NOW and let us get you connected with a dealership.